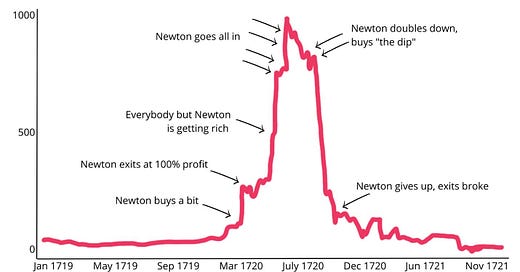

When Price Detaches from Reality

“I can calculate the motions of the heavenly bodies, but not the madness of people.”

-Sir Isaac Newton

Imagine for a second you are one of the smartest people in the world. As part of a broad-based portfolio, you own shares in an average company with average prospects. But shortly after your initial purchase, the share price doubles. Being a smart person, you sell, recognizing the fundamentals no longer justify the valuation. You have made money, and you are happy.

But after you sell, the share price keeps going up. And now all anyone can talk about is how much money everyone is making. Headlines report that most of the respected elites and politicians own shares and are buying more. Promoters create an endless stream of rationale to explain why the price can only go higher. Your friends are getting rich, and whether you admit it or not, you are jealous of their success.

You decide these people can’t all be wrong, the government will only push the price higher, and the gains now seem guaranteed. You go all-in and the share price continues to appreciate.

Until it doesn’t.

Suddenly the share price stops going up and people start to panic. Leveraged trades unwind, selling begets selling, the sentiment shifts, and buyers have disappeared. Within the span of a few weeks, the share price has plummeted and you, along with the rest of your friends, are financially ruined.

You may be thinking, “If I’m one of the smartest people in the world, that surely wouldn’t happen to me.” But this is exactly what happened to Isaac Newton during the South Seas Bubble of 1720.

A lot has changed over the last 304 years, but human psychology is still very much the same. Replace “South Sea Company” with “Cryptocurrencies” and I suspect the human response cycle of caution, FOMO, greed, and loss will look nearly identical.

Today there are plenty of smart people that own cryptocurrencies and there is no shortage of promotion explaining why the coin prices are destined to go higher.

The crypto industry poured over $100mm into races to elect pro-crypto candidates

Trump has praised the idea of a Federal Bitcoin reserve

The anti-crypto SEC chair will be replaced with someone more friendly

Elon Musk is a vocal crypto supporter and should have some role in the new government

Bitcoin ETFs are making it easier to invest in crypto

Bitcoin supply is limited

Bitcoin demand will only go up

This all sounds amazing but every bullet point is simply a new take on the idea that demand is going up and supply is limited. But scarcity by itself is not a source of value. Bitcoin and other cryptocurrencies have no intrinsic value and at the end of the day, that must mean something.

As investors, it is always tempting to say that this time is different. But just as tulip mania was different than railroad mania and the dot com bubble was different than the Nifty Fifty, history doesn’t repeat, but human behavior always does.

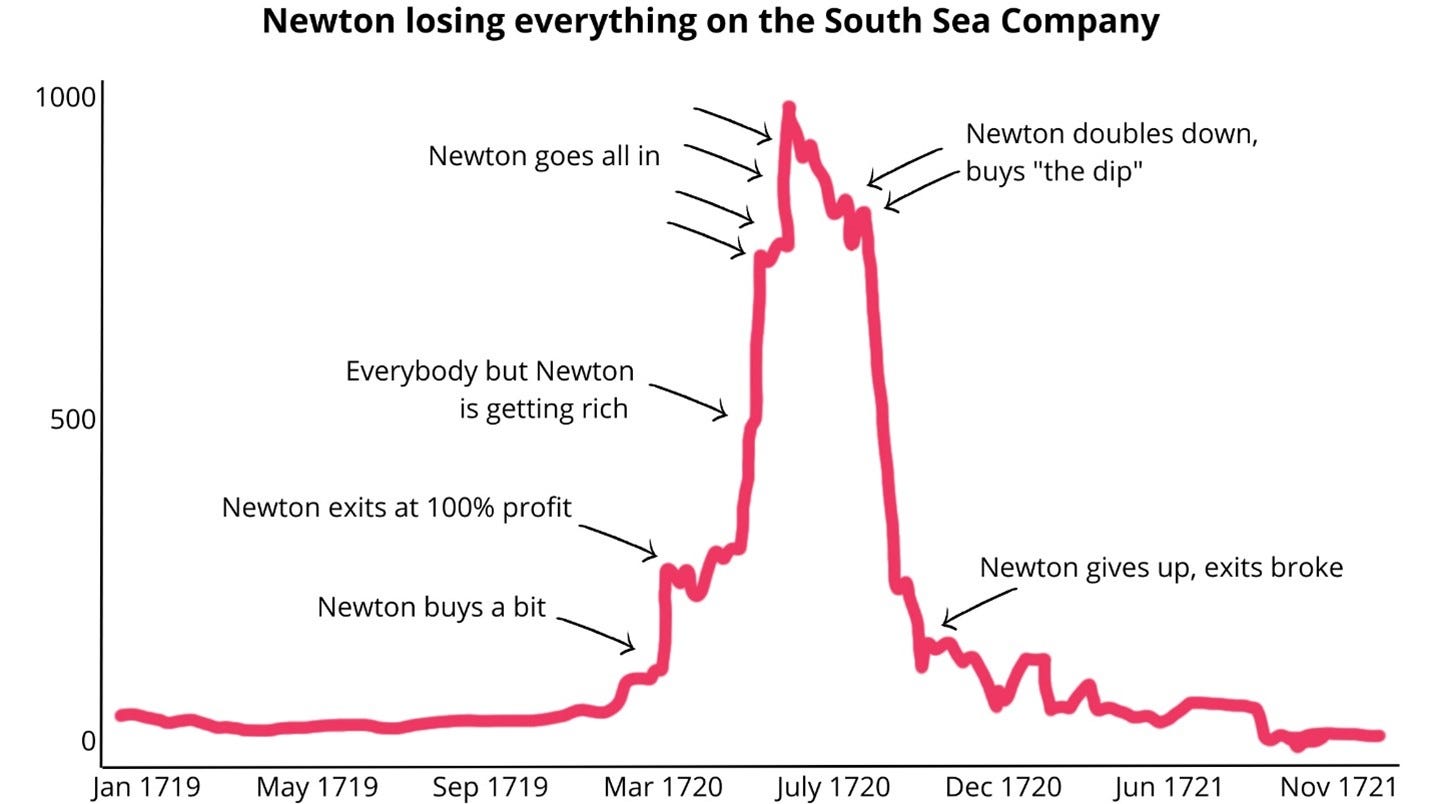

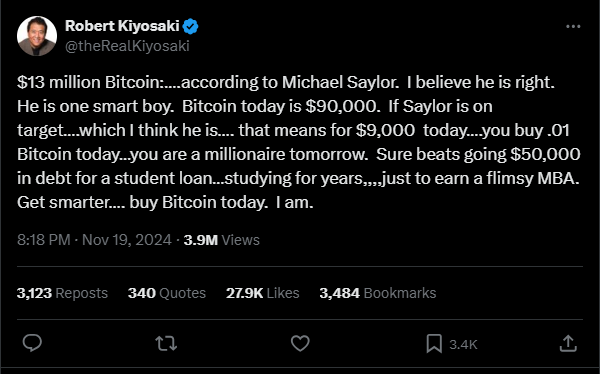

My favorite explanation of Bitcoin came in the form of this tweet:

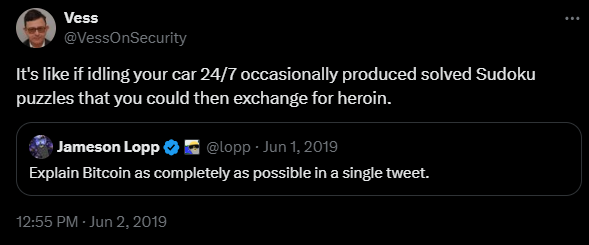

Anytime I hear someone talk about limited supply as a reason for future value, I think about this Beanie Baby guide and its ten-year value estimates based on projected future supply.

When you see posts like this - invest $9,000 today, become a millionaire tomorrow, no effort, skill, or education required - you need to stay far, far away.