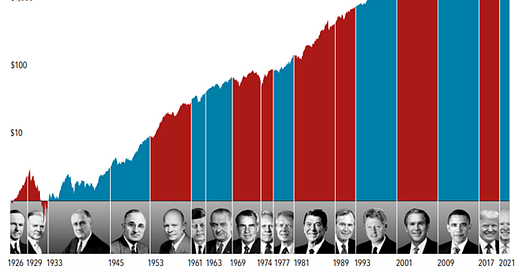

Every four years, people start to believe that the stock market’s future is largely dependent on the outcome of our Presidential election. That simply isn’t true. As pointed out in the below chart from Dimensional, (this version only goes through 2022 but you get the idea) historically, the stock market has trended higher regardless of which party is in office.

But this time could be different. What if I just sit out until the markets feel safer?

There will ALWAYS be reasons not to invest. Today you may be worried about elections, tomorrow it may be geopolitics, recessions, government shutdowns, national debts, worker strikes, natural disasters, terrorism, inflation, or any other nightmare your amygdala can conjure up. But sitting out waiting for ideal conditions has historically never been the answer.

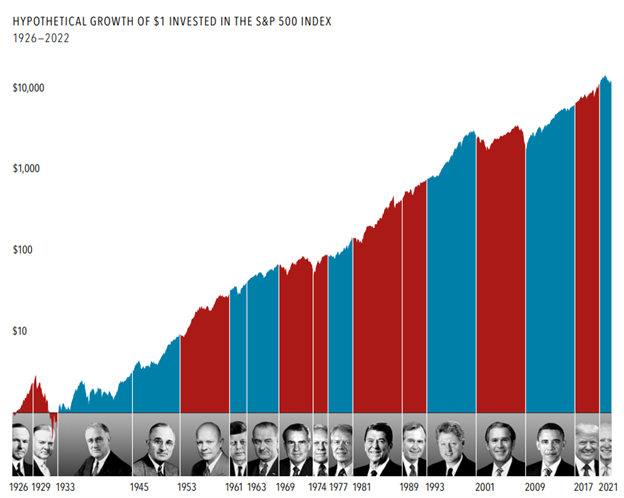

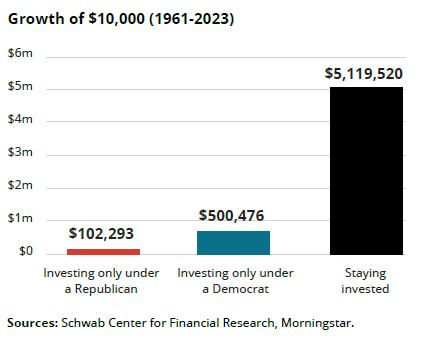

To illustrate this concept in political terms, Schwab’s Liz Ann Sonders and Kevin Gordon created a chart comparing three hypothetical investors. The first invested only under a Republican President, the second invested only under a Democrat President, and the third invested regardless of which party was in office. Their findings:

“Covering the modern period for the S&P 500, investing only when a Republican was in the White House, a $10K initial investment in 1961 would have grown to more than $102K by 2023. On the other hand, the same $10K initial investment would have grown to more than $500K, investing only when a Democrat was in the White House. Some might stop the analysis there and conclude that staying out under Republican presidents and being in under Democratic presidents is a winning strategy. But the real moral of the story is told with the final bar. The same $10K initially invested in 1961 would have grown to more than $5.1M by just staying invested, without regard for the political party in power.” (emphasis added).

Successful investing requires compounding and compounding requires time. The best investors are not the ones with the most research or the prettiest charts. They are simply the ones that can follow a plan, regardless of who wins an election.

I’m told that some people don’t care about my charts and are only here for pictures of the kids. So here they are going back to school for 1st, 4th & 6th grade.

Nothing says “Future Rhodes Scholar” quite like wearing a sweatshirt on a day when the feels-like temp is 108.

When it comes to writing about investments, the disclaimers are important. Past performance is not indicative of future returns, my opinions are not necessarily those of TSA Wealth Management and this is not intended to be personalized legal, accounting, or tax advice etc.

For additional disclaimers associated with TSA Wealth Management please visit https://tsawm.com/disclosure or find TSA Wealth Management's Form CRS at https://adviserinfo.sec.gov/firm/summary/323123