“She is so good at predicting what will happen in books, so bad at predicting what will happen in life. That is why she has always preferred books - because to be alive is so much harder.”

― Alison Espach, The Wedding People

If you watch financial news, you’ve undoubtedly seen a few scary headlines. The April survey of consumer sentiment from the University of Michigan showed that:

Consumer sentiment is declining rapidly

Consumers’ worries about losing their jobs are at levels generally seen during recessions

A record-high share of consumers think business conditions are worsening

Households’ income expectations are declining

Inflation expectations are rising at an unprecedented speed

None of this sounds good, but if history is any indicator, some of the best 12-month stock returns may be just around the corner.

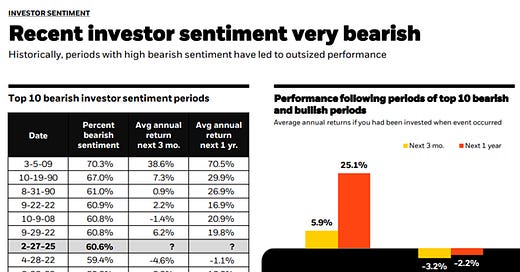

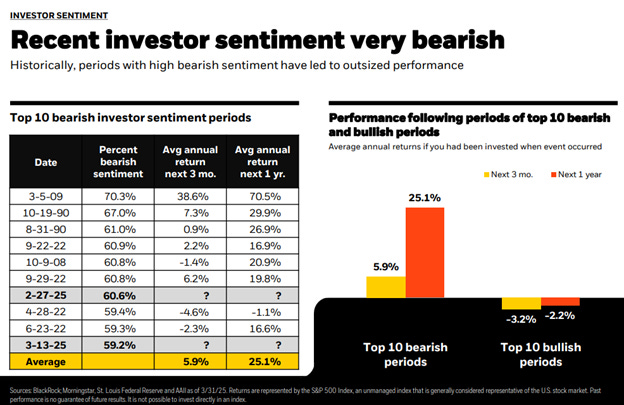

Below is a graphic from Blackrock comparing consumer sentiment and stock performance. The left bar charts reflect returns following the most pessimistic periods, and the right bar charts show what has happened following the most optimistic periods.

Twelve months after the most bearish periods (when Americans were collectively most concerned), the stock market averaged 25% returns. This was a notably better performance than the average return of negative 2% following the moments when Americans were most optimistic.

This may seem odd, but it makes sense.

As Howard Marks has written, risk isn’t always what it seems. When the market feels safe, investors tend to take more risks. Rising prices beget more confidence, and more confidence begets higher prices. Optimism creates bubbles, and bubbles lead to crashes.

When the markets feel less safe (like they do today), it is usually because prices have already declined, the crash has already happened, and bad news has already been priced in. When sentiment is this negative, even bad news can make markets go higher—the bad news just needs to be less bad than expected.

This Too Shall Pass

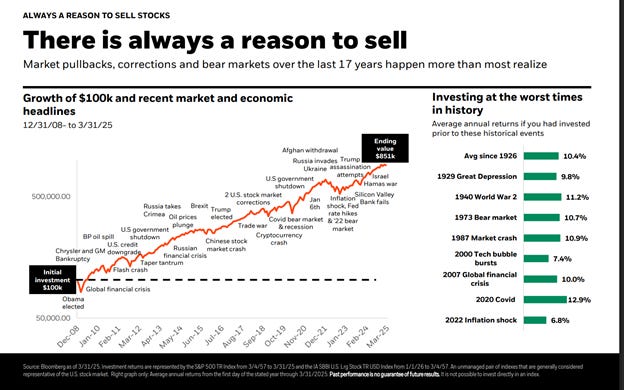

It is easy to look at charts with the benefit of hindsight and admit that everything worked out for those people, in those situations. But this time will always feel different.

While this feeling is natural, and there are no facts about the future, staying invested when everyone else is running for the exits has been, and likely always will be, the most challenging and most profitable decision an investor can make.

When it comes to writing about investments, the disclaimers are important. Past performance is not indicative of future returns, my opinions are not necessarily those of TSA Wealth Management, an SEC-registered investment advisor, and this is not intended to be personalized legal, accounting, or tax advice etc.

For additional disclaimers associated with TSA Wealth Management please visit https://tsawm.com/disclosure or find TSA Wealth Management's Form CRS at https://adviserinfo.sec.gov/firm/summary/323123