Now that the Fed has lowered rates by fifty basis points, talking heads are eager to guess what will happen next.

What is the investment mindset shift in an era of rate cuts?

How does it change the broader economic outlook going forward?

What will happen with the rest of the 2024 rate cuts?

The honest answer is nobody knows. If the last few years have taught us anything it is that near-certain outcomes fail to happen all the time.

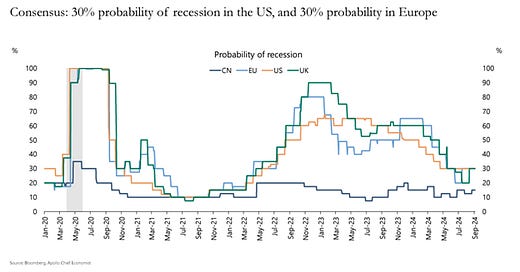

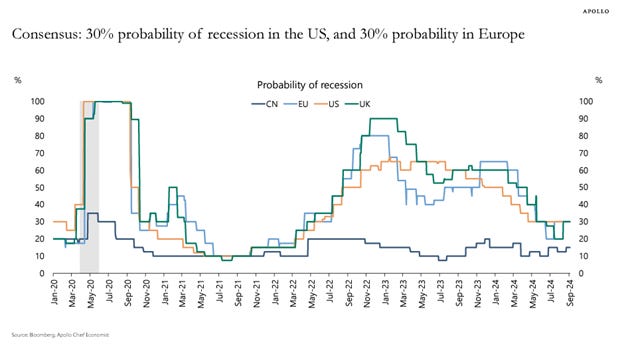

Take this hard-to-read chart from Apollo as an example.

From 2020 through today, there were multiple occasions where recessions were deemed more than likely, but the recessions never materialized. This kind of thing seems to happen a lot. For example:

In 2021, the U.S. Federal Reserve held the view that inflation would prove transitory. They were wrong and were forced to raise rates.

In mid-2022, there was near certainty that the Fed’s rate increases would lead to a recession. The recession never came.

In late 2022, the consensus shifted to the view that inflation was easing, and this would permit the Fed to start cutting interest rates, ensuring the contraction would be mild and short-lived. This optimism ignited a stock market rally.

In 2023 the anticipated rate reductions that created the stock market rally didn’t happen, but the stock market rally lived on.

By December 2023, when the “dot plot” of Fed officials’ views called for three interest rate cuts in 2024, the optimists driving the market doubled down, pricing in an expectation of six.

Nine and a half months into 2024, we finally had the first rate cut.

Will the Fed cut two more times this year, followed by four more cuts next year, and two more cuts in 2026 as they predict? Probably not. Nine officials saw four cuts this year, seven saw three cuts, two officials saw two cuts, and one saw five cuts this year.

They are all smart, maybe some of them are correct and maybe none of them are correct.

The truth is we don’t know what’s going to happen and more importantly, we don’t know how markets will react to what does happen.

As Howard Marks pointed out in his July 17 memo, The Folly of Certainty

The rare person who in October 2022 correctly predicted that the Fed wouldn’t cut interest rates over the next 20 months was absolutely right . . . and if that prediction kept them out of the market, they’ve missed out on a gain of roughly 50% in the Standard & Poor’s 500 index. The rate-cut optimist, on the other hand, was absolutely wrong about rates but is likely much richer today.

Economists, like astrologers, don’t always get it right. As investors, we must plan accordingly.

If you are still reading in hopes of finding something more interesting than economic predictions, here are pictures of our current foster dogs (Lilly, Poe, Tinky Winky, Lala, Dipsy, & Sun Baby). Originally taken in by Fort Bend County Animal Services, and then Jenni’s Rescue Ranch, the Chihuahua mix puppies and mom will be available for adoption in a few weeks and can be transported anywhere in the country.

When it comes to writing about investments, the disclaimers are important. Past performance is not indicative of future returns, my opinions are not necessarily those of TSA Wealth Management and this is not intended to be personalized legal, accounting, or tax advice etc.

For additional disclaimers associated with TSA Wealth Management please visit https://tsawm.com/disclosure or find TSA Wealth Management's Form CRS at https://adviserinfo.sec.gov/firm/summary/323123