In November 2023, I wrote a note titled “The Obvious Outcomes” explaining why things always seem predictable in hindsight.

Given what is happening today with tariffs, it seems like an idea worth repeating. Right now, nobody knows what will happen going forward.

How might our trading partners retaliate?

What are the implications of the tariffs and retaliation on U.S. economic growth, inflation and corporate profits?

How might this impact other aspects of fiscal policy, interest rates and the dollar?

Answers to these questions are all unknowable. But 12 months from now, whatever happens, the outcome will seem obvious.

On one hand, trading partners could retaliate in big ways, markets could continue to go down, and US growth could stagnate. In that case, investors would look back and say, “Of course that happened. They told us about the tariffs, and this market reaction was inevitable.”

On the other hand, the tariffs could be rolled back, the President could extract concessions from our trading partners, and declare victory. After the stock market has rebounded, investors will look back and say, “Of course, that happened. The President and his friends are all billionaires and politicians. They don’t want to see the stock market go down. Any idiot could see it was time to buy the dip.”

Neither of the above outcomes would surprise me.

Pretending to know the unknowable is not a strategy, and our job is not to predict what will happen. Instead, our job is to protect our clients’ retirement plans, which requires hedging for either scenario and apologizing after the fact for not going all in on the winning outcome. So that is what we will continue to do. Our long-term success depends on it.

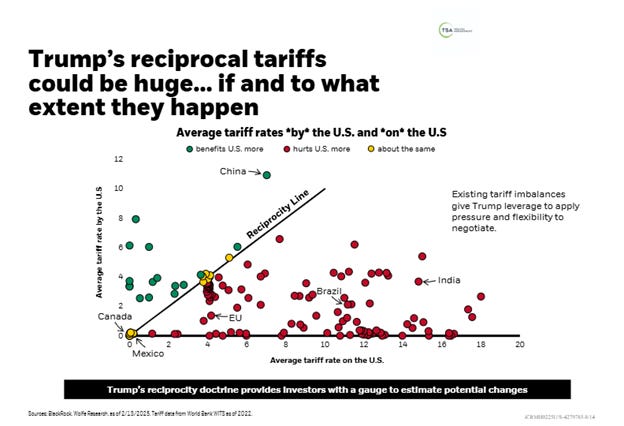

Side note: Back in February, Blackrock put out this chart outlining what we might expect for tariffs based on Trump’s reciprocity doctrine.

Turns out Blackrock wasn’t using the same tariff calculations as the administration and underestimated the impacts. But predicting the future goes like that sometimes.

Personal note: Claire had a her first school performance. She was a butterfly in the Bugz play and delivered her lines like a seasoned pro.

When it comes to writing about investments, the disclaimers are important. Past performance is not indicative of future returns, my opinions are not necessarily those of TSA Wealth Management and this is not intended to be personalized legal, accounting, or tax advice etc.

For additional disclaimers associated with TSA Wealth Management please visit https://tsawm.com/disclosure or find TSA Wealth Management's Form CRS at https://adviserinfo.sec.gov/firm/summary/323123