I’ve started to get calls and emails from clients worried about the bond market. And I know why. I’ve seen the headlines. On April 9th, MarketWatch ran this headline about bond-market chaos:

On April 11th, the AP wrote this headline about a freak sell-off in US Bonds.

These have been followed by countless other headlines and sensationalized YouTube videos explaining how the current policy will destroy bondholders.

But that isn’t what has happened.

What has happened is that the term premium has risen a little bit. This is a fancy way of saying that interest rates on longer-term bonds have increased relative to shorter-term bonds. Some of it is the fiscal situation (the markets don’t know what will happen with inflation, or who the next Fed Chair will be). Some of it has been technical, driven by unwinds of levered basis trades.* Some of it may be foreigners selling Treasuries.

Regardless of why the term premium has been rising, most of the bonds owned by retirees remain in good shape.

Bond Prices Are Up Because Most Interest Rates Are Down

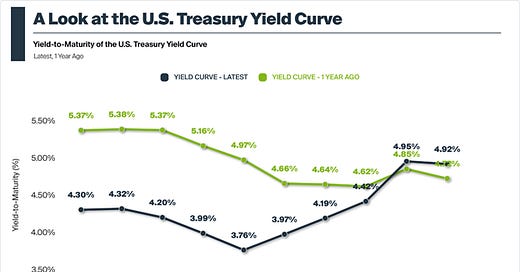

In the chart below, the green line shows interest rates from last year, and the blue line shows interest rates from today. Unless you are loaded up on 20 to 30-year bonds, your interest rate is lower today than 12 months ago. And when interest rates go down, the value of your bonds goes up.

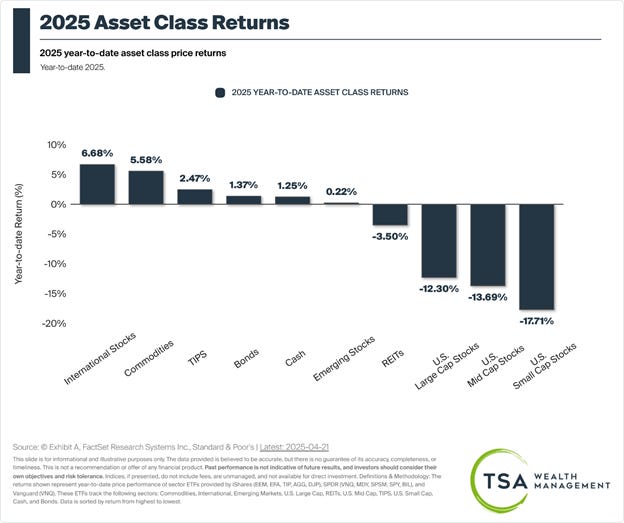

If you don’t believe me, the chart below reflects the asset class returns on a YTD basis through 4/21. The aggregate bond index is up 1.37%, and TIPS (Treasury Inflation Protected Securities) are up 2.47%. Both have outperformed money markets, which are up 1.25%.

In other words, despite what the headlines may say, bonds and diversification continue to do their jobs for retirees. Headlines to the contrary are greatly exaggerated.

*If you want to know more about the basis trade, check out this note from Apollo.

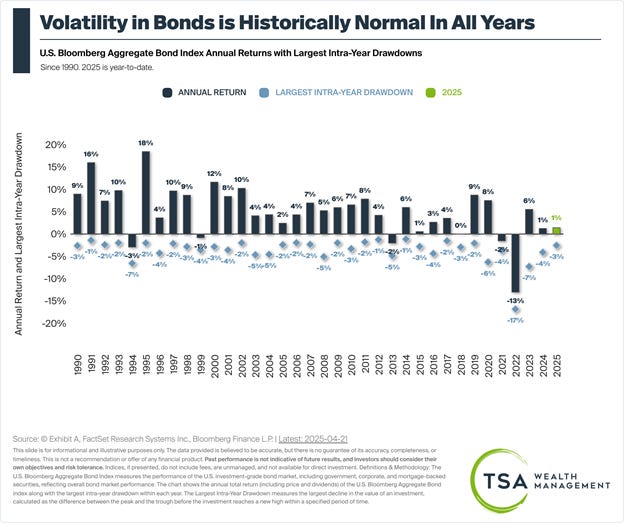

Below is a bonus chart to note that bond market volatility is very normal. The drawdowns are typically less extreme than those in the stock market, but they happen every year.

Personal Note:

Not all headlines are depressing. Last week, InvestmentNews ran this one:

Best Certified Financial Planners in the USA | 5-Star Financial Planners

And they included me in their list.

Pictures of kids and dogs should be back next week.

Disclaimer from compliance: InvestmentNews conducted a nationwide survey between November 18 and December 13 to recognize outstanding financial planners in America. The survey sought nominations for financial professionals who exemplify excellence, integrity, and dedication in helping clients achieve their financial goals. Participants were asked to provide detailed information on nominees, including professional credentials, areas of expertise, and significant achievements.

Nominations required confirmation from the nominee’s compliance team to ensure authenticity and adherence to ethical standards.

The IN team conducted an objective evaluation of each entry, assessing the detailed information provided. This evaluation also involved benchmarking against other submissions to determine the winners.

When it comes to writing about investments, the disclaimers are important. Past performance is not indicative of future returns, my opinions are not necessarily those of TSA Wealth Management, an SEC-registered investment advisor, and this is not intended to be personalized legal, accounting, or tax advice etc.

For additional disclaimers associated with TSA Wealth Management please visit https://tsawm.com/disclosure or find TSA Wealth Management's Form CRS at https://adviserinfo.sec.gov/firm/summary/323123