Last August I wrote a note titled Stock Market Declines Are Normal. At the time, the S&P 500 had dropped 4.5% over the previous week, Japan had seen the worst market decline since 1987, and articles like this one blamed the global market meltdown on fears of recession.

In retrospect, we know that the fears were misplaced, and the market had a great 2024.

Given some of this week’s moves, I figured last year’s note is worth reprinting if only to remind you that the headlines will always be different, but the markets are always scary. The most successful investors are the ones that can tune out the noise.

__

Stock Market Declines Are Normal

(Aug. 9. 2024)

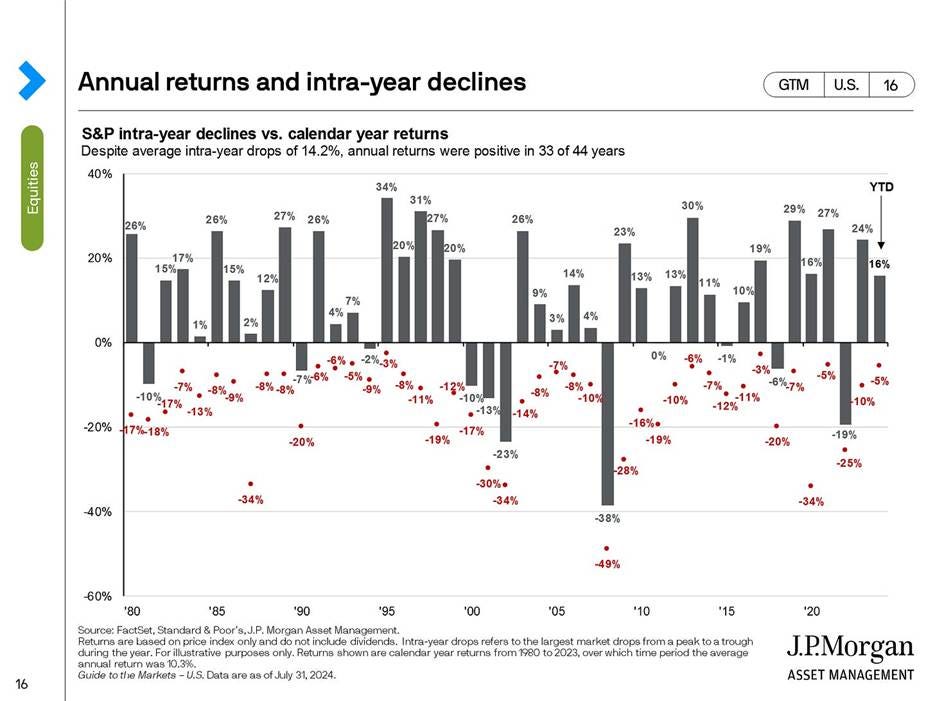

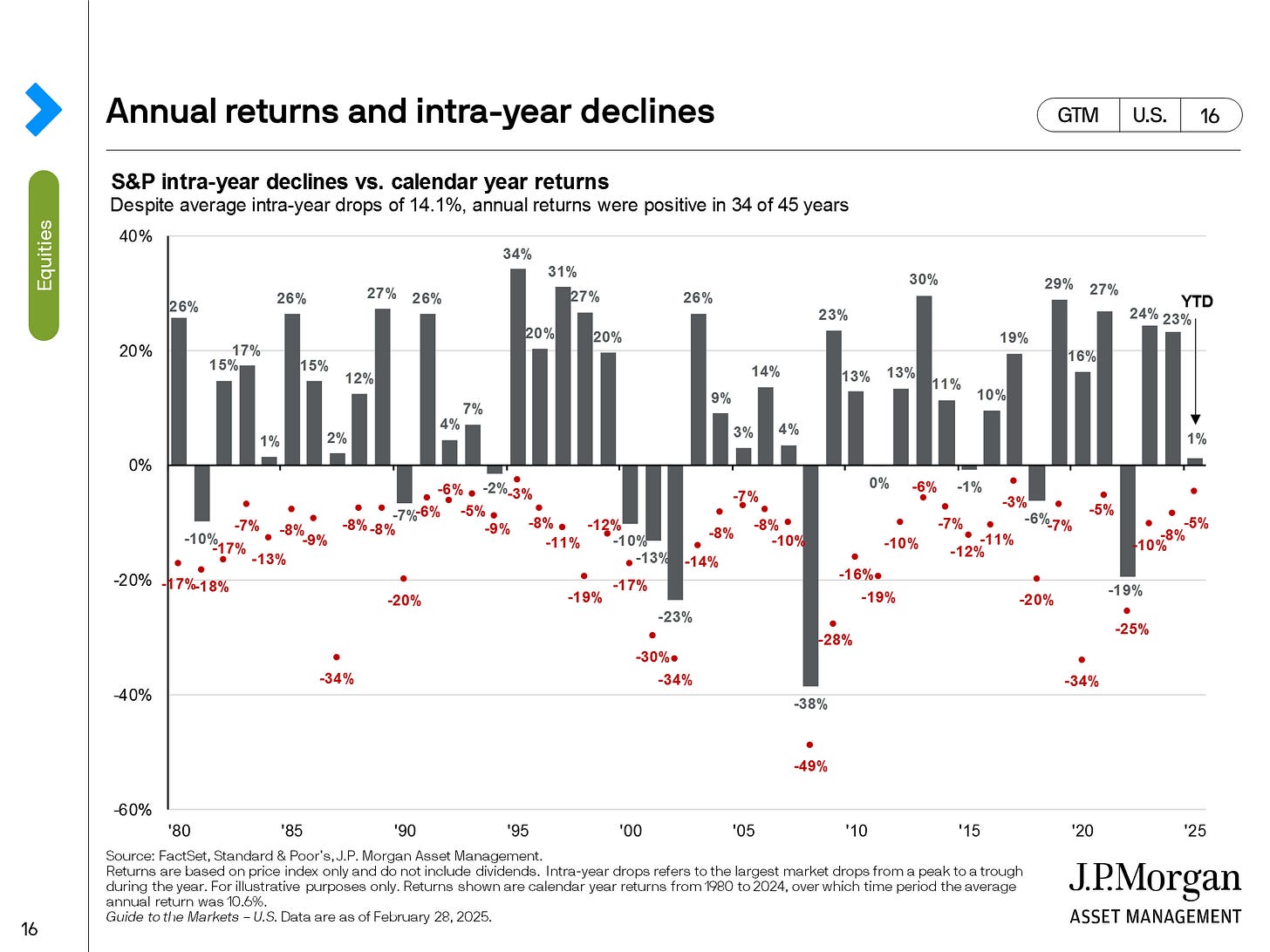

In any given year, the average peak to trough decline for the S&P 500 is 14.2%. Despite these regular pullbacks, the market has been positive 33 of the last 44 years, with an average annualized return (from June 1980 – June of 2024) of 9.165% or 11.873% if you were reinvesting dividends.

After the stock declines on Monday, the S&P 500 was down around 4.5% over the previous five days but still up over 9% on the year.

Stock market declines are a normal part of investing.

I talk about this concept incessantly and send out some version of the above chart one or two times per year, but just as our bodies can’t store vitamin C, our brains can’t store words of reassurance. So, if this seems repetitive to what I’ve said in the past, it is.

But look at these market swings?

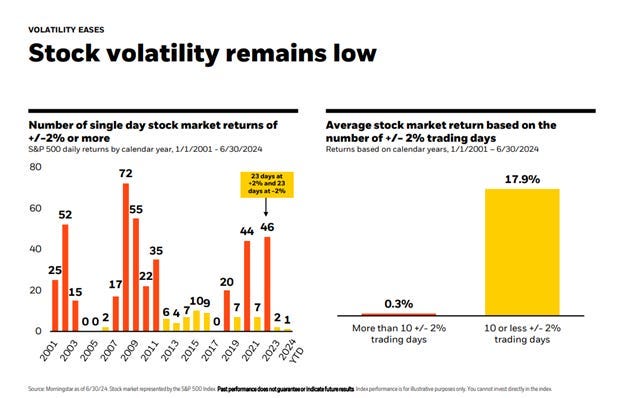

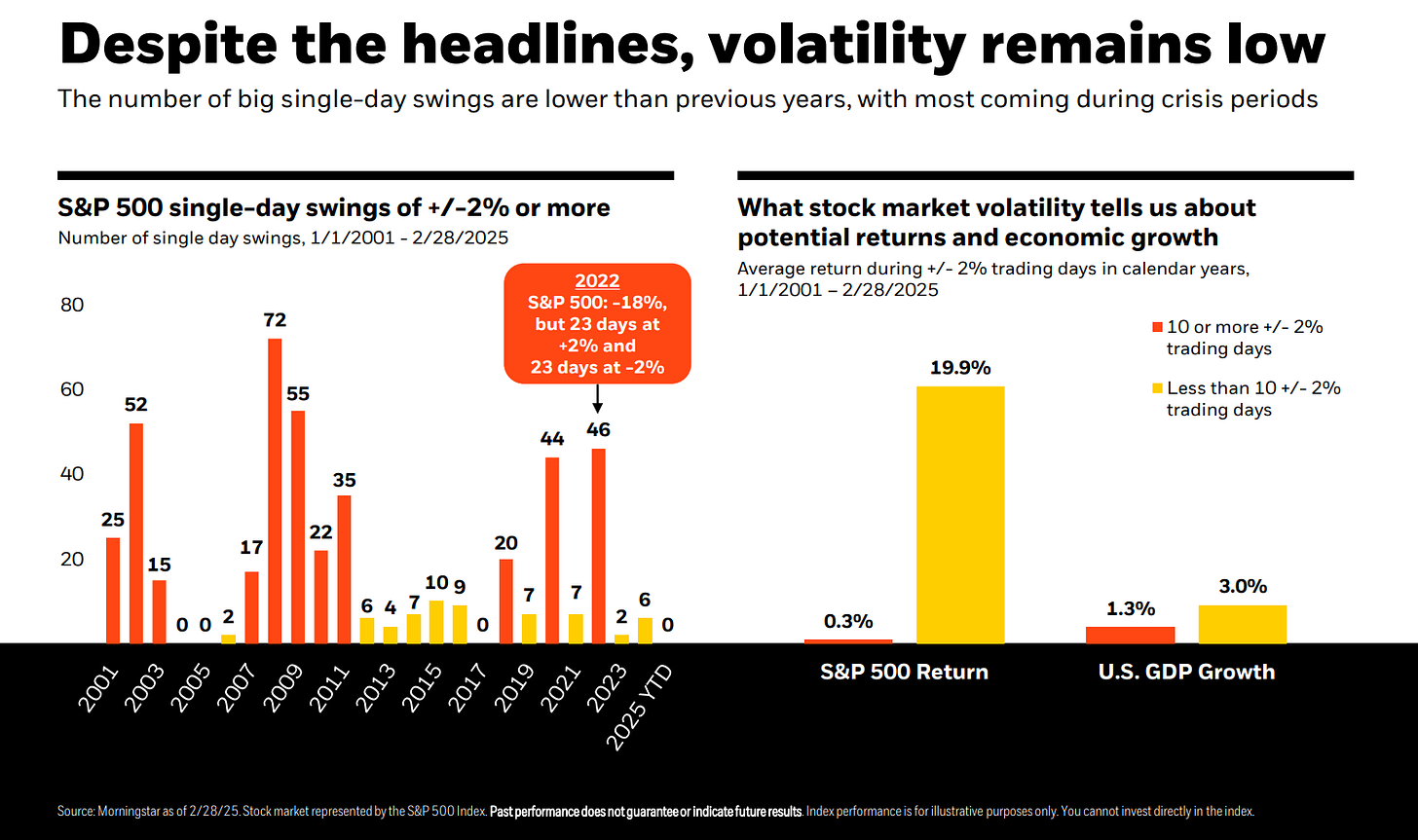

The stock market going up or down 2% on any given day is also normal. We just haven’t seen much of it in the last 18 months, and humans tend to have short memories when it comes to the financial markets. So here is another chart to help make the point.

But why does this week feel different?

Howard Marks has written that risk tolerance is unlimited at the top, and non-existent at the bottom. The investors that were feeling opportunistic when the prices were going higher feel nothing but fear the moment the prices move the other way. The same data points that were positive two weeks ago have transmogrified into omens of recession. This is how it has always been and this is how it always will be.

Humans aren’t designed to be good investors. Our only hope is to tune out the noise, execute our plans, and remember that this too shall pass.

For those that want to see what the charts would look like if I’d written this note from scratch today, here they are with the numbers updated through February

Personal note: For Spring Break 2025 we went skiing in Utah. The kids keep getting faster while I keep getting slower.

Sage mkt decline hindsight ! 🎿⛷️🏂 my favorite sport - & I was introduced to snow + skiing in UTAH … CONOCO assignment, Salt Lake City - 1972 - ‘74 ; then. , Spokane ; then , Newport Beach ( continued snow skiing thru these assignments ).

When it comes to writing about investments, the disclaimers are important. Past performance is not indicative of future returns, my opinions are not necessarily those of TSA Wealth Management and this is not intended to be personalized legal, accounting, or tax advice etc.

For additional disclaimers associated with TSA Wealth Management please visit https://tsawm.com/disclosure or find TSA Wealth Management's Form CRS at https://adviserinfo.sec.gov/firm/summary/323123