As I have been meeting with clients this month, everyone wants to know what stocks will do in 2025.

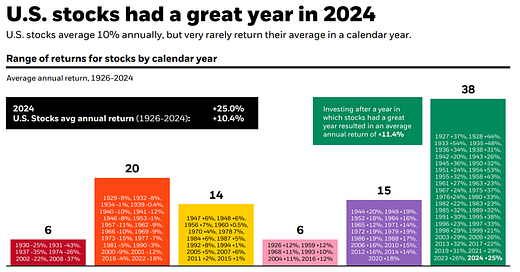

I have no idea. I know all the metrics and historical data, but those are both terrible market-timing tools over 12-month periods. But I still like the question because it gives me a chance to remind people that not all stocks do the same things. For example, you get charts like this one from Blackrock under the headline, “US stocks had a great year in 2024.”

The headline is correct as a general statement. Still, the chart above only looks at the S&P 500 index, which is an aggregate of the 500 largest US companies, with the most valuable companies being weighted more heavily than the smaller ones.* In 2024, 360 of the 500 companies underperformed the index’s average, and at the extreme, companies like Walgreens, Intel, Moderna, and Celanese each lost more than 55%.

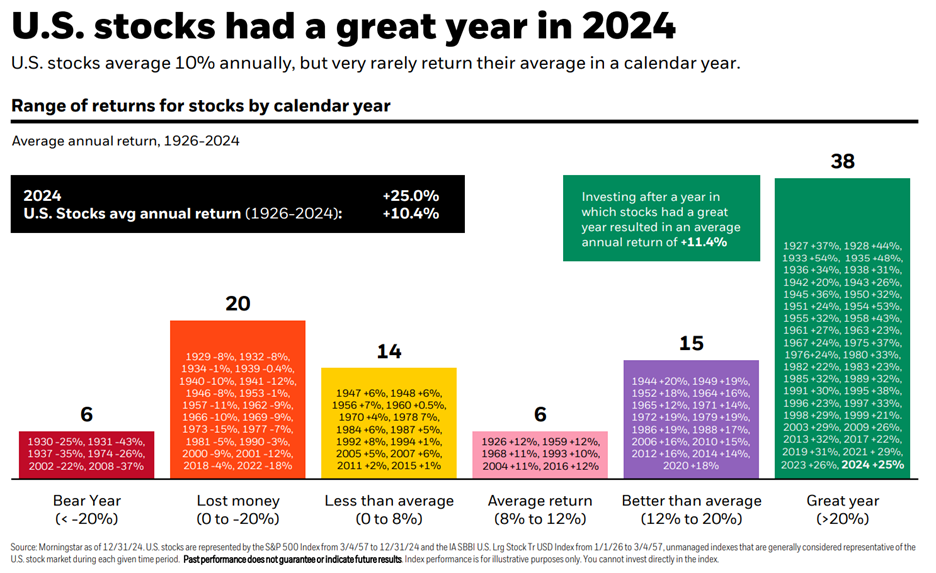

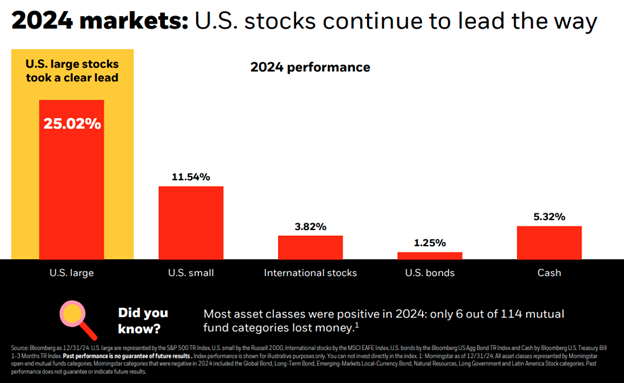

In 2024, US large stocks (the S&P 500 index) were up 25%, driven primarily by big tech. US small stocks (the Russell 2000 index) were up 11%. International stocks (the MSCI EAFE index) were up 3.82%.

What do these disparate numbers tell us about what to expect in 2025? Historically, according to the chart below, not much.

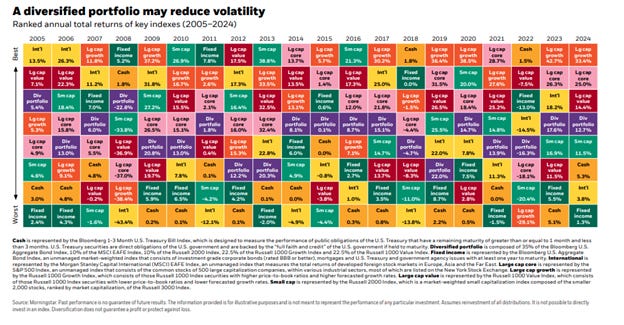

All we can know for sure is that:

This year’s returns will be in some way different from the last;

Today's investors will not profit from yesterday’s growth; and

Diversification will always mean having to apologize for something.

Given these truths, the most sensible thing to do is to continue executing your plan and avoid the temptation to chase returns.

*The S&P 500 includes 500 companies but four companies, Apple, Nvidia, Microsoft, and Amazon, represent 24.20% of the total weight.

Personal Note: Over winter break we traveled out to California along with my parents to visit family. My dad is a big F1 / Lewis Hamilton fan so we are now all team Scuderia Ferrari.

When it comes to writing about investments, the disclaimers are important. Past performance is not indicative of future returns, my opinions are not necessarily those of TSA Wealth Management and this is not intended to be personalized legal, accounting, or tax advice etc.

For additional disclaimers associated with TSA Wealth Management please visit https://tsawm.com/disclosure or find TSA Wealth Management's Form CRS at https://adviserinfo.sec.gov/firm/summary/323123