This week, we hosted a seminar in our office titled Markets v Politics: Making Rational Investment Decisions in a Divided World.

Click here for a pdf copy of the slide deck.

The presentation started with a recap of the stock and bond markets. We did a short outlook for the year ahead and then went over some slides explaining why your political beliefs are likely your portfolio’s worst enemy.

For today’s note, I’ll skip over 41 of the slides and focus on the two that exemplify what happens when investors confuse their political beliefs with market realities.

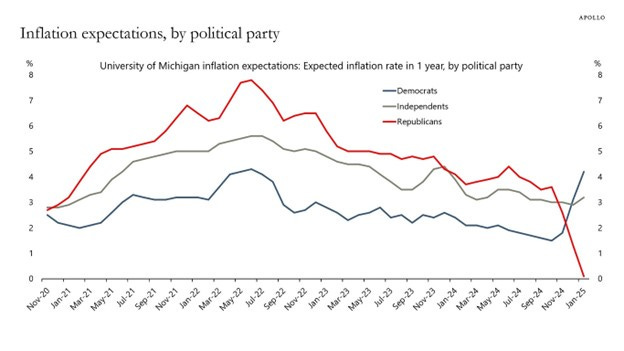

First, this chart from Apollo perfectly illustrates how investor sentiment is shaped by politics rather than fundamentals.

The red line represents Republican investors. Under Biden, they believed inflation would remain a major issue. The moment Trump was elected, their expectations flipped, and they assumed inflation would vanish.

The blue line shows Democratic investors reacting in the opposite way.

Both groups are equally confident—and equally prone to making poor investment decisions as a result.

We’ve seen this pattern play out before:

During Trump’s first term, liberal clients wanted to move to cash, convinced the market would collapse.

Under Biden, conservative clients wanted to do the same thing.

In both cases, doing so would have left massive returns on the table—sacrificing their financial goals for the sake of political alignment.

The truth is, markets can thrive under presidents you dislike and crash under presidents you support—often for reasons completely beyond their control and when investors least expect it.

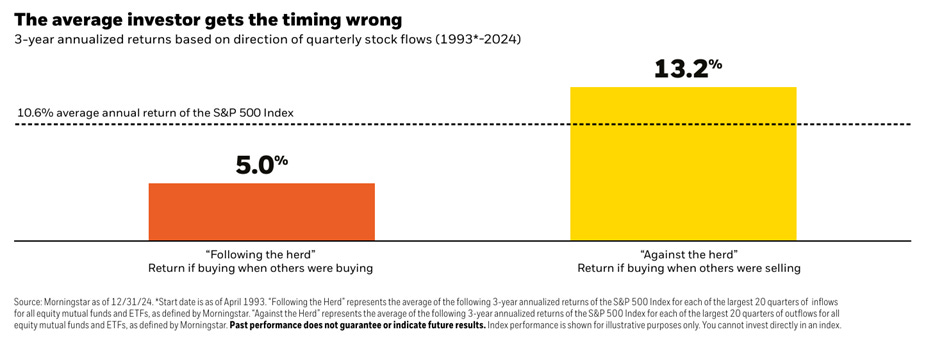

I include the next slide to emphasize the “least expect it” part.

The orange bar in the chart above represents the market returns three years after peak inflows (when investors felt most optimistic about the future). The yellow bar represents the market returns in the three years after peak outflows (when fear was highest and investors were selling). The results? Markets tended to perform significantly worse when investors were confident and significantly better when investors were scared.

So, if politics have you feeling fearful, history shows that the best opportunities often emerge when sentiment is at its lowest. If you’re feeling overly confident, keep your expectations in check because the worst returns tend to follow periods of peak optimism.

Given this reality, the smartest move is to resist the urge to react emotionally (or based on the most recent political headlines) and stick to your long-term plan.

This week, instead of kids or dogs, I’ll leave you with the only two pictures from the seminar.

When it comes to writing about investments, the disclaimers are important. Past performance is not indicative of future returns, my opinions are not necessarily those of TSA Wealth Management and this is not intended to be personalized legal, accounting, or tax advice etc.

For additional disclaimers associated with TSA Wealth Management please visit https://tsawm.com/disclosure or find TSA Wealth Management's Form CRS at https://adviserinfo.sec.gov/firm/summary/323123