If you've been following the news, you may have gotten the impression that your investment portfolio is being crushed. On March 13th, headlines like this one read:

S&P 500 falls more than 10% below recent high as markets rattled by Trump. Key US stock index slides into correction territory as president’s trade wars cause Wall Street volatility

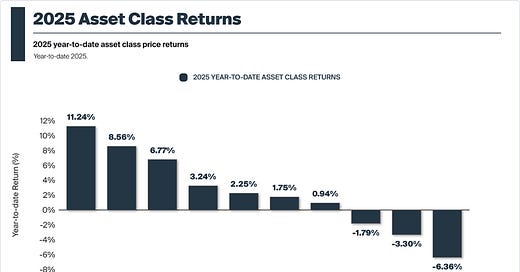

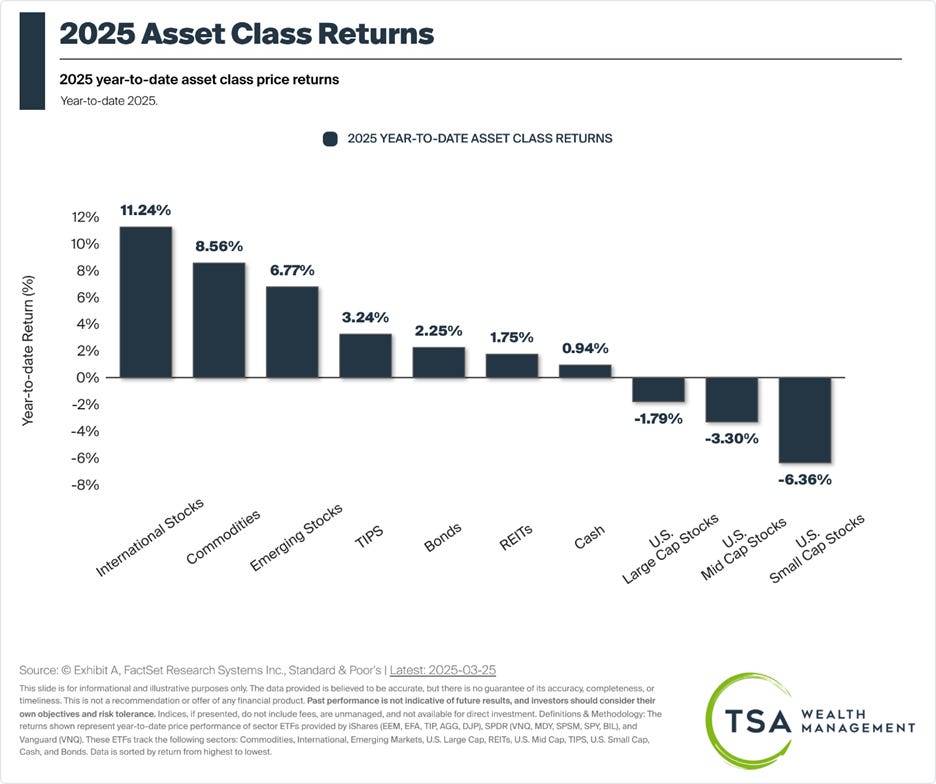

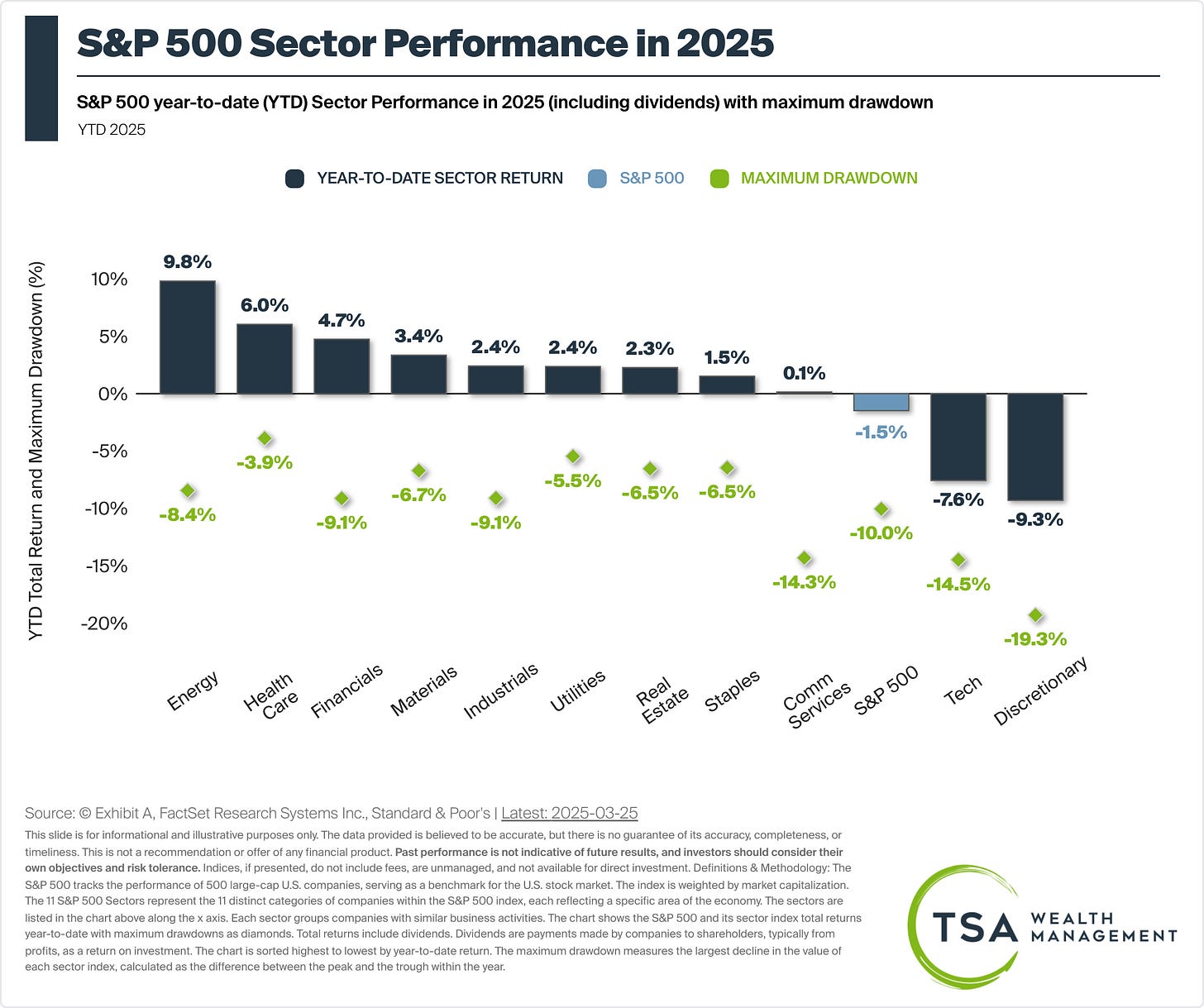

This sounds scary, but for investors that remain broadly diversified, things haven’t been that bad. First, US Stock markets have been down, but everything else - especially international stocks, commodities, and bonds – has been doing well.

Second, even in the US, most sectors remain positive for the year. The tech and discretionary sectors, which collectively represent approximately 35% of the S&P 500, are the negative outliers.

In 2024, nobody wanted to own anything other than the S&P 500. This year investors may be wondering why we bother owning the S&P 500 at all. These changes happen.

As I wrote in January in the note, Predicting Stock Returns

All we can know for sure [about stock returns in 2025] is that:

This year’s returns will be in some way different from the last;

Today's investors will not profit from yesterday’s growth; and

Diversification will always mean having to apologize for something.

Given these truths, the most sensible thing to do is to continue executing your plan and avoid the temptation to chase returns.

The objectionable asset classes of the moment will always differ, and diversification will never feel ideal. But when the future is uncertain (which it always is), owning a mix of investments that tend to do different things remains the investor’s best option.

If you are looking for something to do next Saturday, Jenni’s Rescue Ranch is hosting its annual crawfish boil. TSA Wealth Management is a sponsor, my wife is one of the event organizers, and my kids and I will be out there raising money for the dogs.

When it comes to writing about investments, the disclaimers are important. Past performance is not indicative of future returns, my opinions are not necessarily those of TSA Wealth Management and this is not intended to be personalized legal, accounting, or tax advice etc.

For additional disclaimers associated with TSA Wealth Management please visit https://tsawm.com/disclosure or find TSA Wealth Management's Form CRS at https://adviserinfo.sec.gov/firm/summary/323123