"Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves." – Peter Lynch

Every year, I highlight some timeless wisdom from Berkshire Hathaway’s annual letter to shareholders (see our notes from 2024 and 2023), and this year is no exception. For those unfamiliar with Berkshire Hathaway, it is a trillion-dollar company run by Warren Buffett that has accumulated a war chest of $325 billion in short-term treasuries as it awaits its next big purchase.

Is this a sign that the Oracle of Omaha is scared of the current market?

Probably not. Buffett directly addressed this issue in last month’s annual letter to shareholders. The full text can be found here. The section quoted below starts on page 7:

Despite what some commentators currently view as an extraordinary cash position at Berkshire, the great majority of your money remains in equities. That preference won’t change. While our ownership in marketable equities moved downward last year from $354 billion to $272 billion, the value of our non-quoted controlled equities increased somewhat and remains far greater than the value of the marketable portfolio.

Berkshire shareholders can rest assured that we will forever deploy a substantial majority of their money in equities – mostly American equities although many of these will have international operations of significance. Berkshire will never prefer ownership of cash-equivalent assets over the ownership of good businesses, whether controlled or only partially owned.

Paper money can see its value evaporate if fiscal folly prevails. In some countries, this reckless practice has become habitual, and, in our country’s short history, the U.S. has come close to the edge. Fixed-coupon bonds provide no protection against runaway currency.

Businesses, as well as individuals with desired talents, however, will usually find a way to cope with monetary instability as long as their goods or services are desired by the country’s citizenry. So, too, with personal skills. Lacking such assets as athletic excellence, a wonderful voice, medical or legal skills or, for that matter, any special talents, I have had to rely on equities throughout my life. In effect, I have depended on the success of American businesses and I will continue to do so.

In other words, Buffett isn’t abandoning stocks and neither should you.

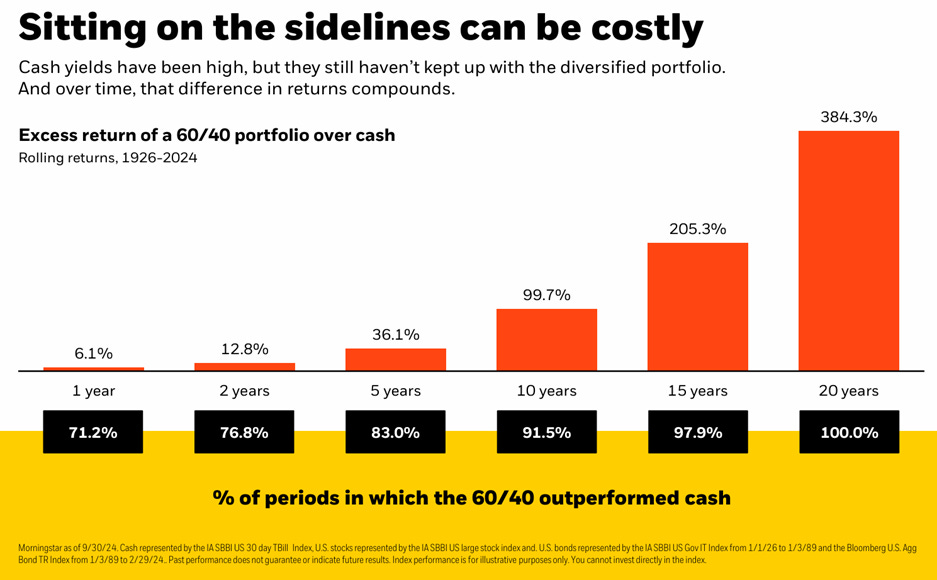

First, as highlighted by the chart below, if scary headlines caused you to sell your 60% stock and 40% bond portfolio so you could move into a money market fund that felt safer, and you then spent one year on the sidelines “waiting for a better time to invest,” you had a 71% chance of being worse off, with the average underperformance coming in around 6.1%.

If you started with a $1 million portfolio, you were, on average, $61,000 worse off after one year, $360,000 worse after five years, and $1 million worse after ten. Abandoning a balanced portfolio for the perceived safety of cash can be a costly mistake that compounds over time.

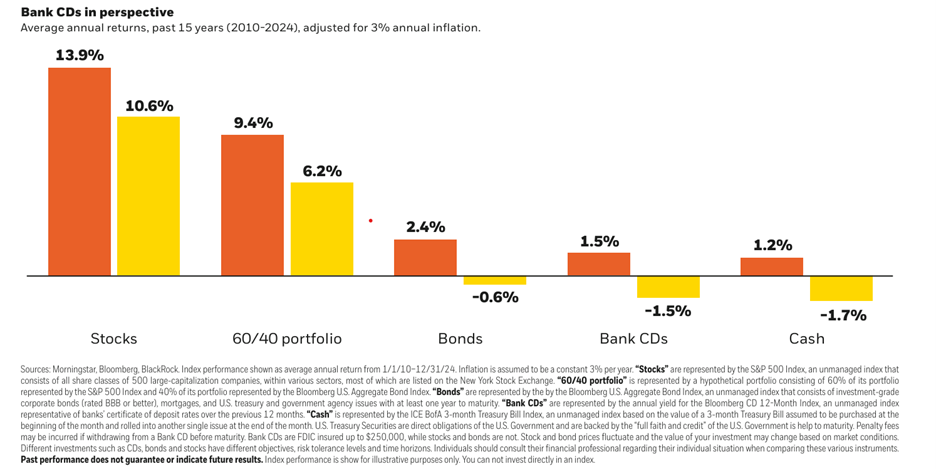

Second, while cash can be useful for managing short-term uncertainty, uncertainty isn’t an investor’s only risk. As Buffett notes, cash and fixed-rate bonds can quickly have their spending power eroded by inflation, and for retirees, that is also a very real risk. The chart below highlights the difference in asset class returns over the last 15 years after adjusting for annual inflation of 3%.

Finally, all investing involves risk. Financial planning is simply the art of understanding which risks you are willing to take and managing those risks in the way best suited to accomplishing your goals. For Warren Buffett, that means building up a strategic cash reserve sufficient to go elephant hunting when others have limited access to capital. For the average retiree, it means owning a mix of stocks, bonds, and cash in a ratio sufficient to meet all future cash obligations without ever being forced to sell investments when they are down.

Things will never go exactly according to plan, but, as I’m sure Buffett would agree, that doesn’t make the planning any less important.

When it comes to writing about investments, the disclaimers are important. Past performance is not indicative of future returns, my opinions are not necessarily those of TSA Wealth Management and this is not intended to be personalized legal, accounting, or tax advice etc.

For additional disclaimers associated with TSA Wealth Management please visit https://tsawm.com/disclosure or find TSA Wealth Management's Form CRS at https://adviserinfo.sec.gov/firm/summary/323123