2025 Price Targets

As we quickly approach the New Year, it feels like a good time to remember that every firm on Wall Street has issued a report outlining where they think the S&P 500 will end in 2025, but none of the highly educated guesses are likely to be correct.

For example, below are some of the 2025 S&P 500 price targets, as Sam Ro at TKer put them together.

Today, the S&P is around 6,000, and all predictions above assume the market will go up in line with the historical average return of the stock market. However, as we’ve pointed out previously, this is one of the least likely things to happen since the annual return for the S&P 500 index came within two percentage points of the market’s long-term average of 10% in just seven of the past 96 years.

For comparison, here is the same chart with last year’s predictions:

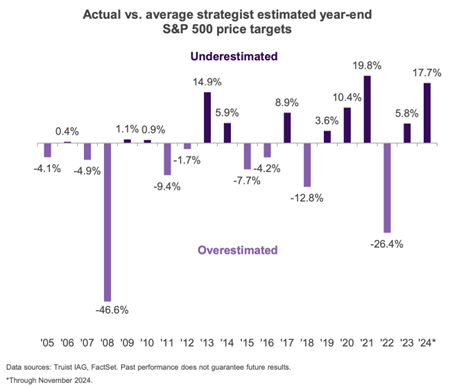

And here is a chart originally from Truist that shows that these estimates consistently overestimate or underestimate by extensive margins.

But as with all Wall Street predictions, these come with unhelpful caveats like this one from Morgan Stanley:

“Looking forward to 2025, we think it will continue to be important for investors to remain nimble around market leadership changes, particularly given the potential uncertainty that the recent election outcome introduces. This is also a reason why we are maintaining a wider than normal bull versus bear-case skew — base case: 6,500; bull case 7,400; bear case 4,600.”

In other words, “We think you will be up 8%, but you could be up 25% or down 25%. Just be nimble and be prepared to trade if something happens!”

Roger that.

And since this is my last note before Christmas and the start of Chanukah, from my family to yours, happy holidays!